TL;DR

- Understand that you should self-custody your Bitcoin.

- Download the Phoenix mobile wallet.

- Back up the wallet following Phoenix's backup steps. Be very careful with your backup!

- Get yourself some Bitcoin by trading, buying it or texting me.

Overview

Getting started with Bitcoin is simple, quick, and incredibly powerful!

One of the core ideas with Bitcoin is that Bitcoin allows you to remove all 3rd party risk with your money, but keep all the benefits of digital payments.

What this means practically is that when you hold your Bitcoin, you can send and receieve money ( as Bitcoin ) to anyone in the world without any permission from a bank, government, or legal entity. Nobody can stop you from making transactions and nobody can take your money from you ( when held properly, which we'll go over ).

With the recent financial weaponization of banks and governments in Canada, the US, the UK, and even globally with Paypal, unilaterally seizing people's funds or blocking them from transacting, the need for "self-custody" ( the action of taking ownership of your money ) has never been greater.

The great thing is that with only a few actions, you can take self-custody and remove all 3rd party risk from your money.

Let's go over what I believe to be the fastest way to get up and running with Bitcoin and self-custody. This will not be heavy on technicalities, but instead will focus on the pragmatic aspects of getting setup, transacting, and long therm security of your money.

If you have any questions, don't hesitate to text me at (713) 264-1320 or email me at lucas@soundmoneymining.com.

Please note that nothing mentioned here is to be construed as financial advice.

Start with a hot wallet

What is a hot wallet?

There are several types of "wallets" that exist out there, but the biggest distinction is between "hot" and "cold" wallets. All that "hot" vs. "cold" means is whether or not the wallet is directly connected to the internet. The implication is that "hot" wallets are connected to the internet, therefore posing a greater risk of being hacked or stolen. "Cold" wallets are typically kept on a hardware device that exist offline, not connected to the internet, and therefore reduces the chance of the being hacked or stolen.

With the right security measures in place, both can be incredibly secure; however, I recommend starting with a hot wallet for simplicity and only keeping enough in the wallet that you'd use for day to day activies. I personally don't ever keep more than a few hundred dollars in my hot wallet.

So let's get one!

Download a hot wallet.

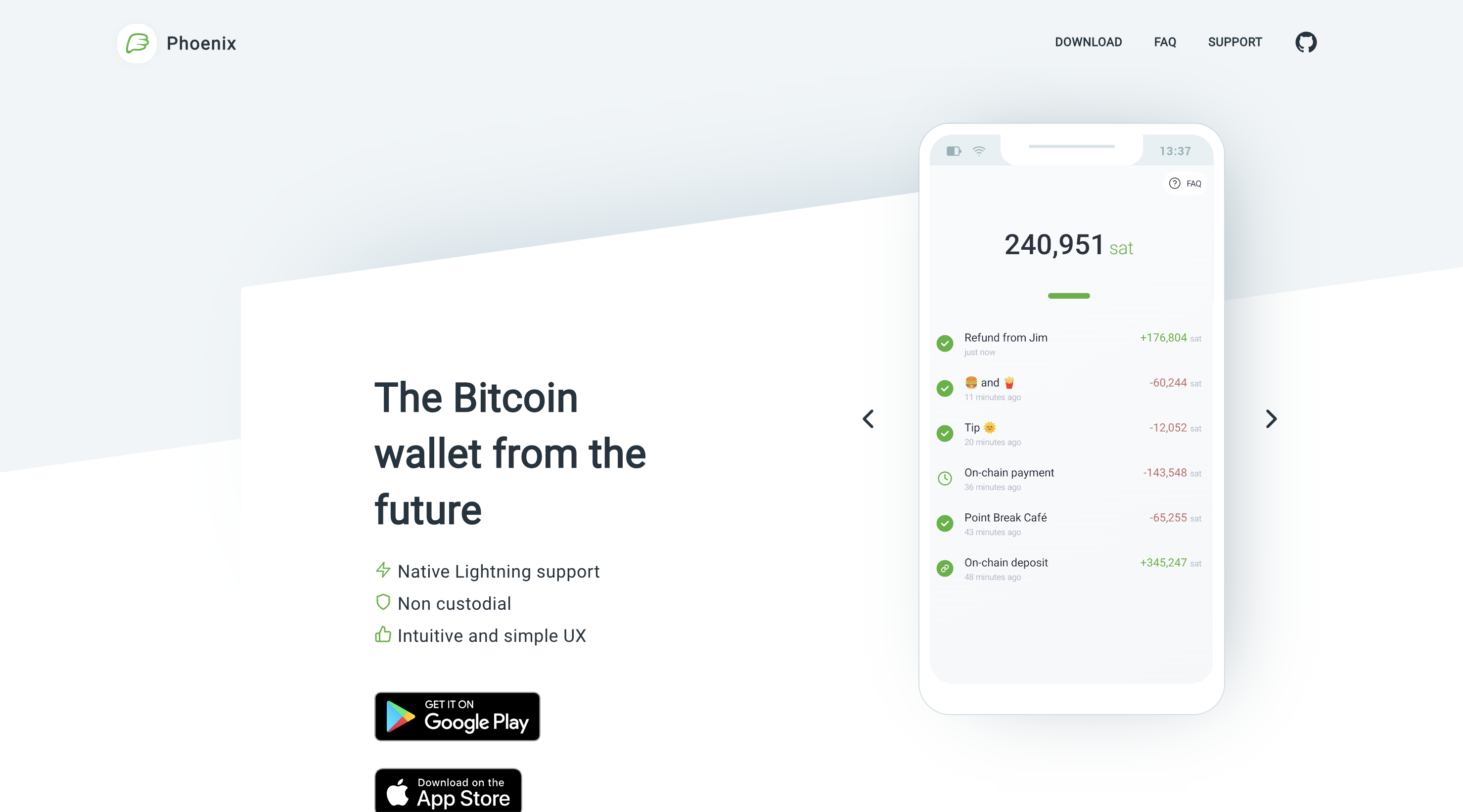

There are several hot wallets that you can download on your phone, like Phoenix Wallet, Muun wallet, Wallet of Stoshi or Blue wallet. The thing you're looking for is whether or not the wallet is "non-custodial", meaning that they don't hold onto the Bitcoin for you. For example an app like Strike is great as an on / off ramp for buying Bitcoin, but they are custodial, meaning at the end of the day you don't own the Bitcoin. They do.

We want to avoid that if we can, because taking custody is so simple, it's not worth the risk. You can watch a video comparing the different hot wallets that have Lightning support here. ( More on lightning in a second. )

For simplicity, you can take my recommendation:

I personally use the Phoenix wallet as it's a non-custodian mobile, hot wallet that integrates seemlessly between Bitcoin and Lightning networks.

For the sake of using Bitcoin, you do not need to understand what each of those items means; however, I'll give a brief practical definition here:

- Non Custodial: This means that you are responsible for your monetary security. There's no insurance if you lose your seed phase, but it also means nobody can take away your Bitcoin.

- Mobile: Not desktop, which there are several like Electrum or Sparrow.

- Hot: We've gone over this one 👍

- Lightning: Lightning is a "layer 2" technology that sits on top of and adheres to all the rules of Bitcoin, but makes some small trade offs to enable very low transaction fees. I use lightning for all my day to day small payments.

As always, I strongly encourage you to do your own research to understand what all is going on.

After you download Phoenix, you simply click "Create New Wallet" and voila! You've got a Bitcoin wallet! You can now send and receive Bitcoin from anyone in the world! It's that simple!

If you noticed, you didn't need to add a name, an address, a credit score, or any identifiable information. With Bitcoin, you don't need to disclose your personal details to anyone in order to send money. You simply literally cannot do this with the traditional financial system.

If you want extra help setting up your Phoenix wallet, you can watch a tutorial like this one:

One additional note is that for the very first transaction you conduct on Phoenix, there is a 10,000 sat fee which is native to the Lightning network to open up the channels that allow for payments to be made on the network. This is not a fee from Phoenix, but part of the underlying technology that ensures the security of the network.

Wallet notes

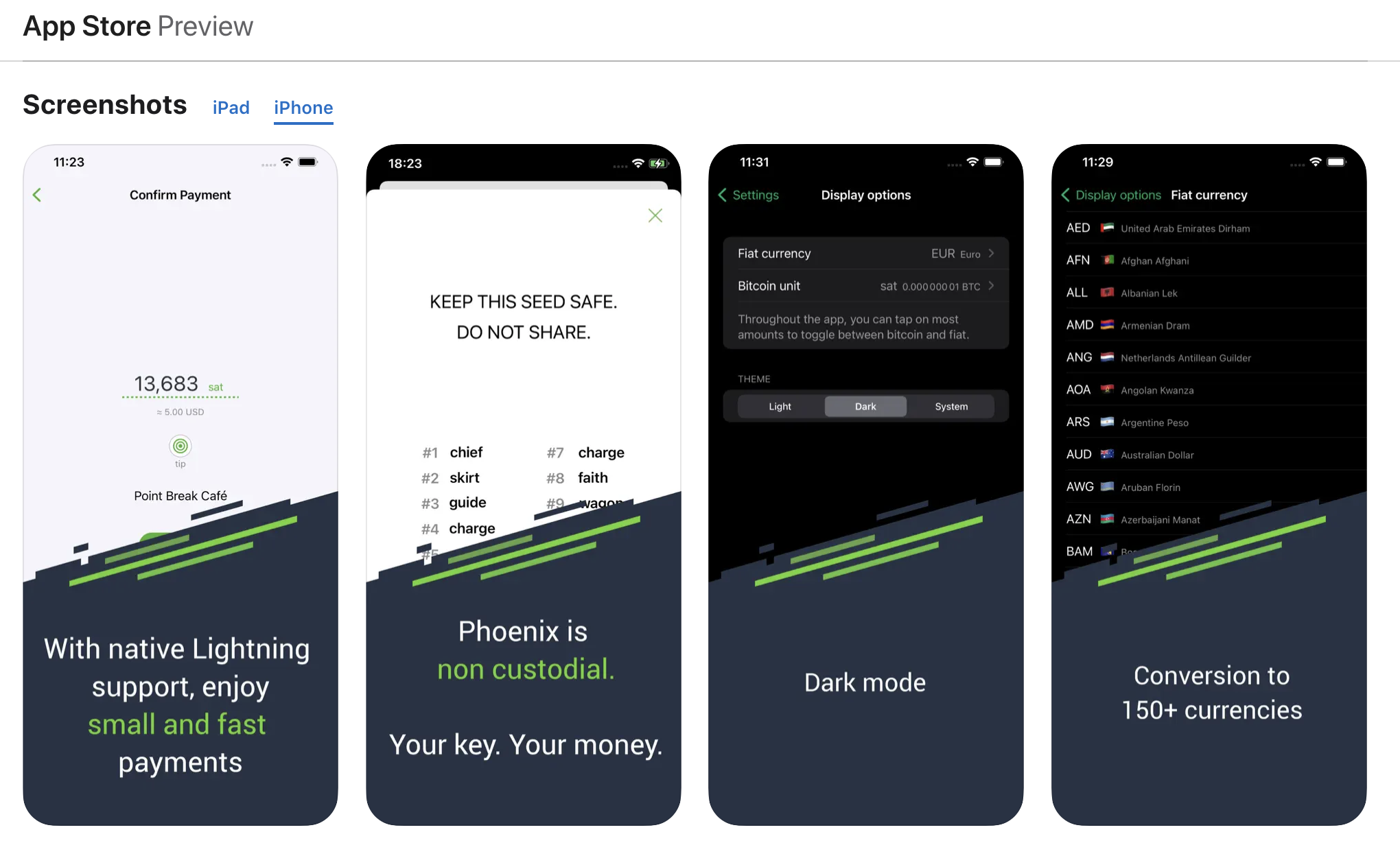

With anything Bitcoin related, it's crucial to only use tools and platforms that are transparent and reliable. For example, this means only using open-source wallets. Open-source means that the software's source code is available for anyone to review.

You can see Phoenix's open-source code on Github.

This transparency allows for a community of developers to inspect, modify, and enhance the software, ensuring its security and functionality. Moreover, ensuring that a wallet is "reproducible" means that its build process of the application can be independently verified, adding another layer of trust.

Back up your wallet!

Imagine if you lost access to your email and didn't have a way to recover it. Frustrating, right? The same applies to your Bitcoin wallet, except... you could lose your money forever, so it'd be a little more than frustrating.

In the context of Bitcoin, not having a backup could mean losing access to potentially thousands of dollars. Unlike traditional banking systems, there's no customer support to call if things go wrong. Your backup is your lifeline.

This is the trade-off with self-custody. Self-custody means you take responsibility for you money, and in return, you reduce the risk of having your money seized and your money becoming devalued / debased.

If you're using the Phoenix wallet, as recommended earlier, they offer a simple backup process and record your seed phase is a secure place.

You always want to make sure you that you keep any backup information ( private keys, secret keys, seed phrase, backup phrase, etc... ) private and offline.

I recommend keeping your keys written down in a lock box / vault and never keep the keys and your phone or hardward wallet ( more down below ) together.

I'm a little nutty, and I keep my back ups stamped into metal to be extra sure I don't lose my money:

Get yourself some Bitcoin!

Ask for it

Receiving Bitcoin from someone else is as easy as sharing your Bitcoin address with them. Just like an email address, but for Bitcoin, your address will look like a string of numbers and letters. Once you share it someone, they can send you Bitcoin.

In this case, if you text me your address, I'll send you 5000 SATs. Seriously just ask.

For clarity, a "Satoshi" or "SATs" is the smallest unit of Bitcoin, named after its mysterious creator, Satoshi Nakamoto. Think of it like cents to a dollar. Currently, 100 million SATs make up one Bitcoin.

Sell or Trade for it

Offer your products or services and accept Bitcoin as a payment method. This not only gives you the opportunity to accumulate Bitcoin but also helps in promoting its adoption in everyday transactions.

Buy some from a friend

Just as you might exchange cash with a friend, you can do the same with Bitcoin. If someone you know has Bitcoin, you can give them cash (or any other form of payment you both agree on), and they can send Bitcoin directly to your wallet.

i.e. a friend owes you money cash from a dinner, drinks, or event, request the money back in Bitcoin!

Buy some from an exchange and withdraw it

Exchanges are platforms where you can buy or sell Bitcoin.

If you're in the United States:

Platforms like Coinbase, Webull,

Robinhood, and Strike allow users to

buy Bitcoin.

If you're purchasing small amounts of Bitcoin, I would recommend setting up an account on an exchange like Strike where it's very easy to setup recurring purchases.

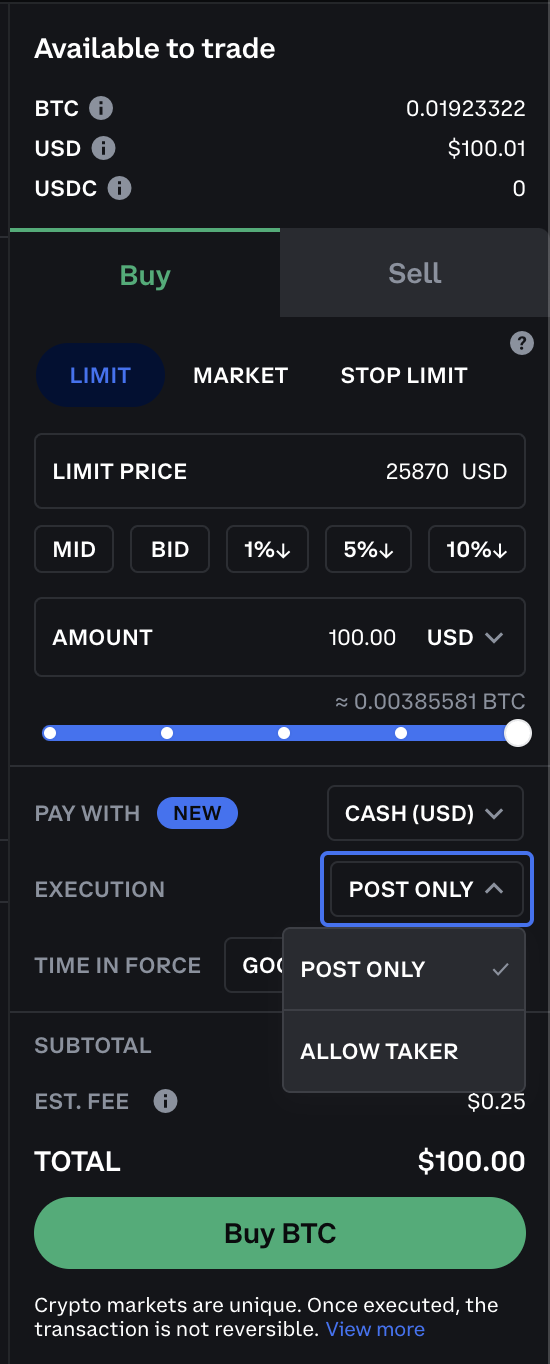

However, when I buy Bitcoin, I tryto reduce the amount of fees I pay if I can. With Coinbase's "Advanced Trade" setup, I accomplish this by:

- Deposit USD to Coinbase.

- Select the "Limit" purchase option.

- Set the "max" option for USD

- Set the Limit price to the current market price for simplicity

- Change the "execution" method to "Post only"

All that "post only" does is tell Coinbase, "do not go out of your way to fulfill this order. Instead wait until a seller is selling that exact amount." From my experience, even purchases of several thousand dollars have never had any issues.

Here's a screenshot of what this setup would look like if you were buying $100 of Bitcoin from Coinbase, and you can see that the fee is only $0.25 for $100 or 0.25%. Pretty good.

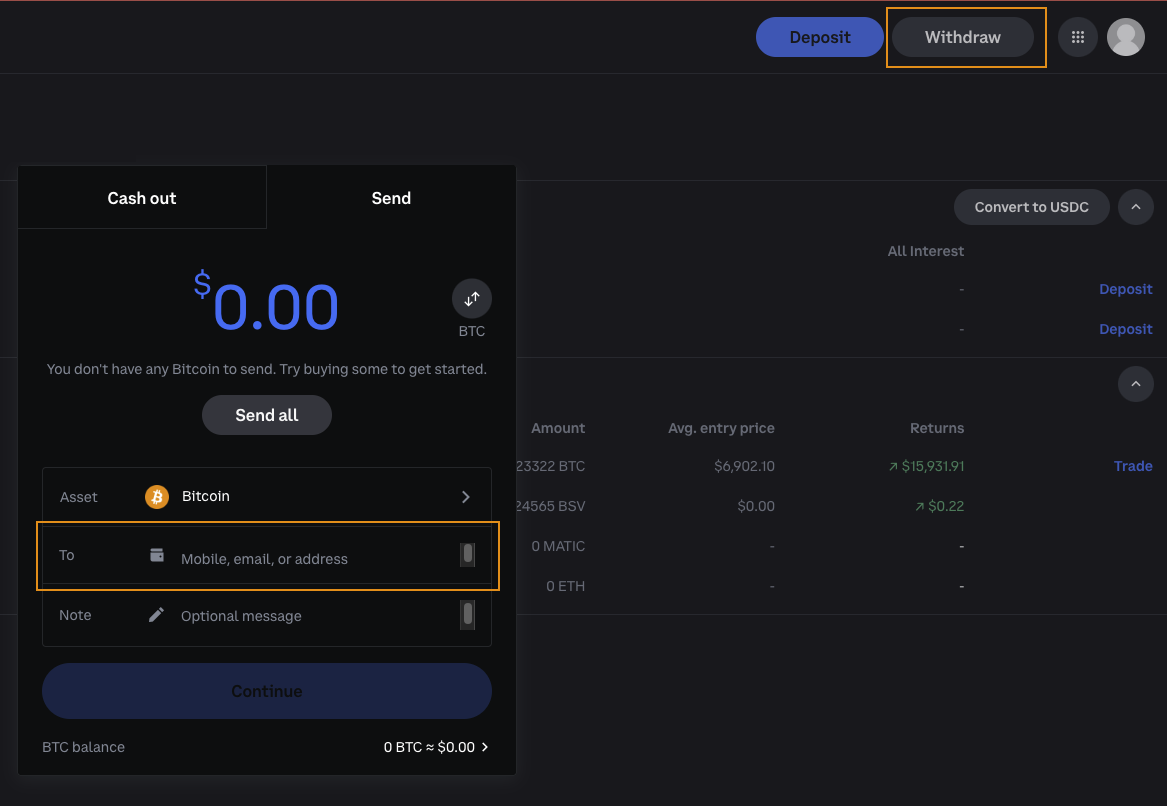

Lastly, you must widthdraw the funds from Coinbase to your wallet. Coinbase will only let you send to a Bitcoin address, and not a Lightning address; however Phoenix makes this very simple to understand.

If you don't want to use Coinbase, that's okay too. Any of the other exchanges will do the trick, so long as the exchange let's you withdraw your Bitcoin. There are several places that tout selling you Bitcoin, but don't have any mechanisms to take custody of your Bitcoin. You want to avoid that!

If you're outside the United States:

Binance is one of the world's largest exchanges and is a popular choice for many international users.

Note: When you buy from an exchange, you must identify yourself before you can withdrawal your Bitcoin, meaning that when you withdrawal, there is a small chance that your individual bitcoin addresses will be identifable in the future. While this isn't a long term issue, it's good to understand that if someone wanted to know which addresses you own, you would be a greater risk of being forced to identify your Bitcoin addresses, and they could be monitored for future use.

Bitcoin Transactions Notes

Here are a few rules of thumb when using Bitcoin:

Use 1 address per transaction

This reduces the "traceability" of money connected to you and keeps you a little more secure.

Use Lightning for small payments

The Lightning network will make transaction fees much smaller and is equally as simple to use. If you're using the Phoenix wallet, and you want to receive some Bitocin, make sure you select the "Lightning" option which will generate a different QR code.

Only keep a small amount in a hot wallet

As mentioned before, keeping large sums of money on a mobile, hot wallet is not advised. For larger Bitcoin storage, I recommend taking a look at the hardware wallets suggested below.

Congratulations! You're ready to go!

If you've setup your wallet, backed it up, and recieved some Bitcoin, you've achieved something remarkable! With simply a hot wallet, like Phoenix, you have everything you need to send and receive Bitcion! With the backup you have the means to recover your money if you ever lose your phone. It's that easy.

Additionally, you have:

- Shielded your funds from potential external interference or seizure.

- Empowered yourself with the ability to transact globally.

- Stepped into a financial paradigm where inflationary tactics can't devalue your wealth.

Next steps

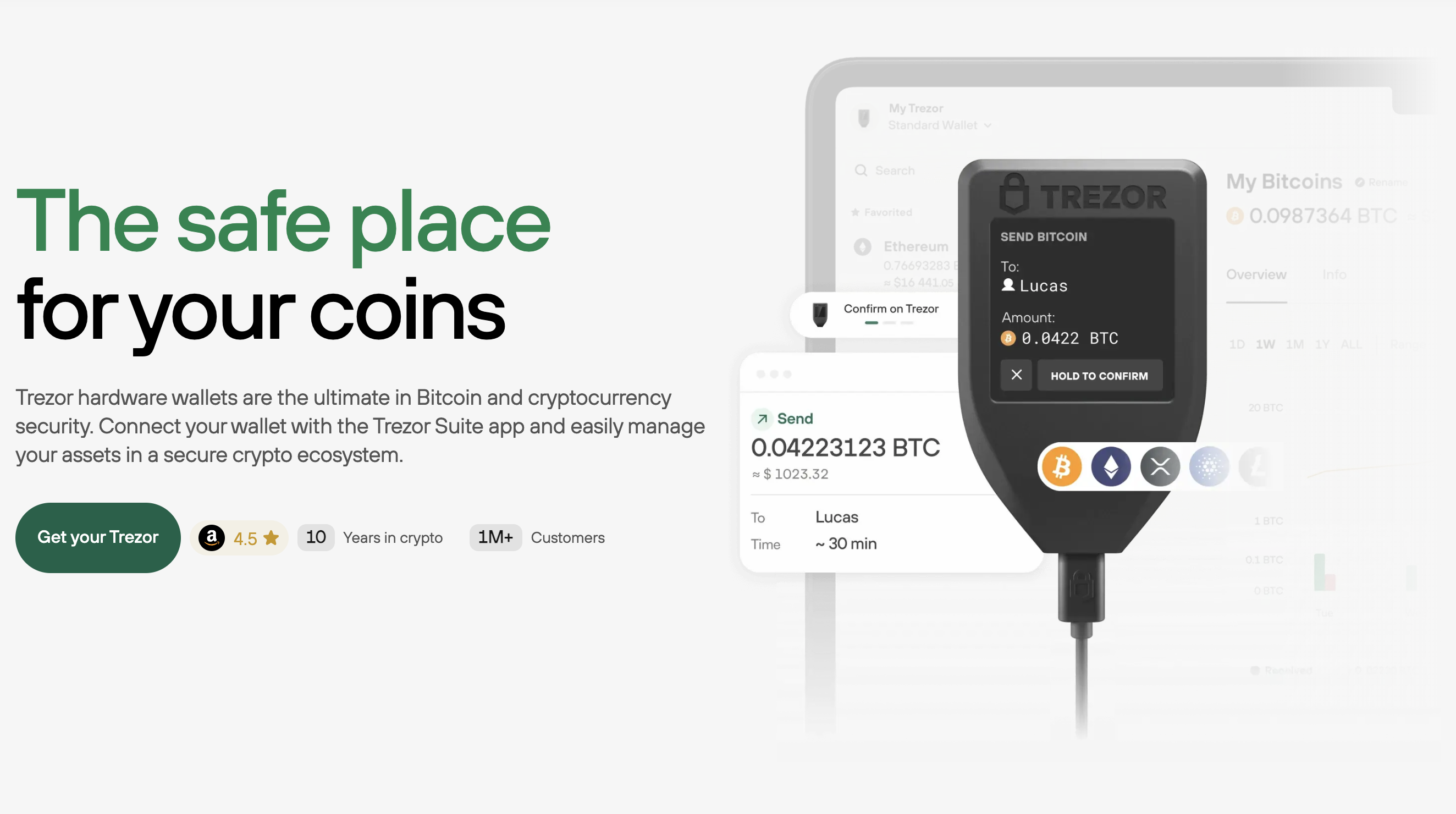

Buy a hardware wallet

A hardware wallet is a physical device that holds your Bitcoin private keys. These private keys are like the keys to a lock box at a bank; however, if you lose your Private keys, you might not be able to retrieve your bitcoin. Hardware wallets store your private keys in such a way to not expose your private keys to the internet and add additional layers of security on sending Bitcoin from your wallet.

There are two hardware wallets that I would recommend:

Trezor

Trezor is one of the first open-source hardware wallets on the market. Its interface is user-friendly and the security is some of the best in the business.

Cold Card

Coldcard has probably the best security and tons of advanced features, and it's a favorite among tech-savvy Bitcoin enthusiasts.

Both are excellent choices, but the best one for you depends on how nerdy you want to get. When evaluating hardware wallets, just like hot wallets, I recommend that you ensure any wallet you use is open-source, reproducible, and has a Bitcoin only version of the wallet. This will ensure maximum security of your wallet.

Consider recurring Bitcoin purchases

Consistency is key. Setting up a recurring purchase allows you to gradually accumulate Bitcoin over time. This strategy, often referred to as "dollar-cost averaging," can help in reducing the impact of volatility on your purchases. Simply choose an exchange, set an amount, and select a frequency, like weekly or monthly.

I strongly recommend you do your own research on Bitcoin to determine your personal comfort level for buying more Bitcoin or setting up recurring purchases.

Move your money off exchanges

When you buy Bitcoin from an exchange, you must periodically move your Bitcoin from the exchange to your personal wallet in order to ensure you have self-custody of the Bitcoin. If any exchange decides to withhold your Bitcoin, they can unilaterally prevent you from getting access to your money.

This is akin to not leaving large amounts of cash at a store; you'd rather keep it somewhere safe. On Coinbase, for instance, you can do this easily using the "Withdraw" button and send your Bitcoin to your hot or cold wallet.

Always make sure that you are sending the money to your wallets, hot or cold.

Continue Learning!

Your journey doesn't end here. Dive deeper into the world of Bitcoin:

- Understand the foundational concepts of money, inflation, and the core principles of Bitcoin.

- Read recommended books like "The Bitcoin Standard" or "The Internet of Money" to gain a more profound understanding of the philosophy and mechanics behind Bitcoin.

- Explore informative websites like hope.com, bitcoin-only.com, and 10 Hours of Bitcoin.

Remember, the world of Bitcoin is vast, and there's always something new to learn. Welcome aboard!